Large Percentage of Baby Boomers Bought and Sold Businesses in Q1 2014

Individual Buyers Tap Home Equity Lines to Finance Sale of Businesses Valued $2 million to $50 million in 2014; Decrease in Funding from Friends and Family in Q1 2014 Compared to 2013

LOS ANGELES, Calif. – Advisors reported that 65 percent of their new sellers and 41 percent of their buyers were baby boomers in Q1 2014, according to the First Quarter 2014 Market Pulse Quarterly Survey Report published by the Pepperdine Private Capital Market Project, International Business Broker Association (IBBA) and M&A Source, and released today by Pepperdine University’s Graziadio School of Business and Management. The quarterly report evaluates market conditions for businesses being sold in Main Street market (values under $2 million) and lower middle market (values $2 million to $50 million).

of Buyer Equity Sources of Buyer Equity

For Main Street, the number one reason driving sellers to market is business owners

seeking to retire, followed by burnout. In the lower middle market, health issues

are listed as one of the main reasons for selling businesses valued between the $2

million to $5 million.

For Main Street, the number one reason driving sellers to market is business owners

seeking to retire, followed by burnout. In the lower middle market, health issues

are listed as one of the main reasons for selling businesses valued between the $2

million to $5 million.

Businesses valued in the $5 million to $50 million range show the greatest diversity of sale drivers since the survey began in 2012 with retirement, new opportunities, and acquisition all tied at 20 percent, followed by family issues at 13 percent.

“The older boomers are selling and the younger boomers are buying which is affecting both sides of the transaction,” said Scott Bushkie, director of IBBA and president of Cornerstone Business Services. “Despite this increased activity, values are not likely to significantly increase for Main Street opportunities as long as there continues to be a larger number of baby boomers selling than there are buyers looking to purchase. We would need to see other market scenarios take precedence for valuations to change.”

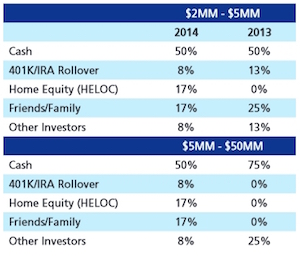

Survey results also indicate that home equity lines of credit (HELOC) are playing a more significant role in financing lower middle market deals in 2014. HELOC financing was conspicuously absent in these categories in 2013 and the reintroduction of HELOC loans is consistent with reports of increased lending activity.

For businesses valued between $2 million - $5 million, HELOC increased to 17 percent in 2014 up from 0 percent in 2013 and financing from friends and family decreased to 17 percent in 2014 down from 25 percent in 2013. For businesses valued between $5 million - $50 million, there was a significant shift from cash (75 percent in 2013) to Home Equity and Friends/Family (both at 17 percent) and 401K/IRA Rollover (8 percent) in the first part of 2014.

“All the data suggests that lower middle market M&A will continue to play in sellers’ favor,” said Dr. Craig Everett, director of the Graziadio School’s Pepperdine Private Capital Markets Project. “Active buyers, available cash, aggressive financing, cheap debt—these are all aligned for strong price points.”

Reason to market

The Main Street market was dominated by individual buyers in Q1 2014, most of them first time business owners. Existing companies had the strongest presence in the $2 million - $5 million sector at 43 percent. In the $5 million -$50 million sector, private equity groups were the primary players, representing 67 percent of closed transactions.

The first quarter 2014 Market Pulse Quarterly Survey Report is available at: https://bschool.pepperdine.edu/privatecapital.

Other key findings:

- As deals get larger, advisors are more likely to describe conditions as a seller’s market. The shift continues to more of a seller market, year over year. However, for businesses below $2 million in value the survey shows that buyers can take advantage of good values on the market.

- Year over year, most deals closed faster in Q1 2014. The return to more traditional timeframes, closer to pre-recession closing times is likely due to greater confidence from both buyers and sellers combined with more aggressive financing positions from lenders across the U.S.

- Advisors expect new business will continue to grow in the next three months, with sentiment remaining strong at a 3.70 index on a five-point scale. An index above 2.50 indicates more advisors view market conditions as favorable than poor. Expectations for valuation multiples also remain positive at a 3.14 index, indicating more advisors expect multiples to stay the same or better.

- Advisors continue to report that unrealistic expectations are the biggest mistake sellers make when trying to sell their business. Unrealistic expectations dwarfed all other pitfalls including declining business sales, burn out, poor financial record keeping, and emotional attachments.